Anyone who follows corporate earnings knows that getting an accurate read from these earnings estimates can be difficult. With this problem in mind, Estimize was created. Now with more than 13,000 buy-side, sell-side and independent analysts included in our dataset, we’re more representative and more accurate than the Street around 70% of the time.

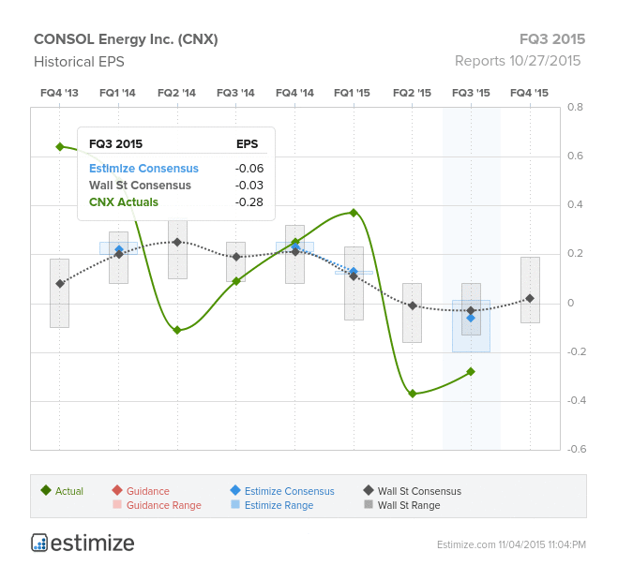

It’s common for the Estimize consensus to be more bullish than Wall Street, the sell-side is notorious for being far too conservative. However, it’s the cases in which Estimize expectations are below the Street when you really have to pay attention. Consider CONSOL Energy which reported Q3 results on October 27. Estimize was looking for EPS of -$0.06, far more bullish that the Street’s -$0.03. Consequently, after reporting EPS of -$0.28 the stock dropped by 21% by the end of the day.

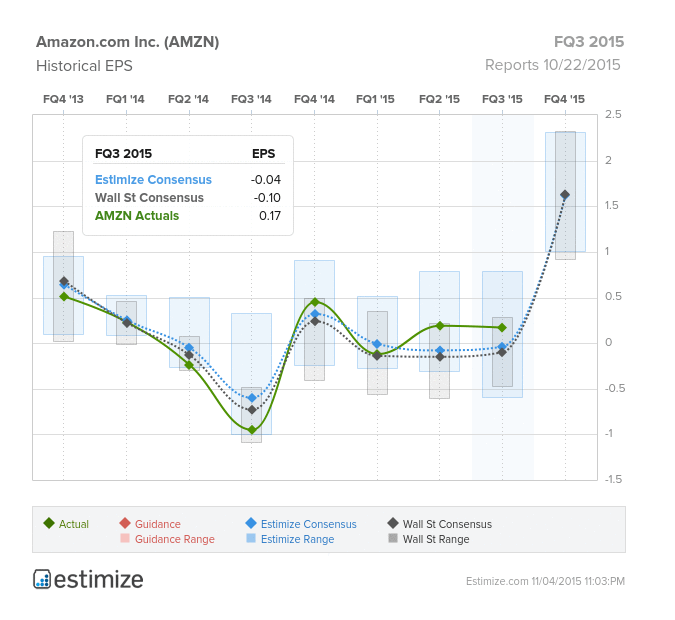

Or take the Amazon report three weeks ago. The Estimize consensus of -$0.04 was well above Wall Street’s prediction for -$0.10. Combined with the Screener, AMZN was identified as a BUY 6 days before the release of Q3 2015 results, and after reporting EPS of $0.17 the stock rose 11%.

There are several other trade ideas like these that be well researched and executed with Estimize's consenus and the Screener. Wall Street experts and sell-side experts are notoriously conservative. Why lose out on potential gains with an estimate that doesn't represent the expectations of the larger investment community?