A primary goal for data Vendors is to maximize the total population that consumes their data products. Vendors accomplish this by using their data in order to satisfy a market need.

In order to make the best use of their time and available resources, Vendors will want to begin with a small, focused set of products that address existing market needs. A compelling product that resolves an existing market problem/need will find immediate success.

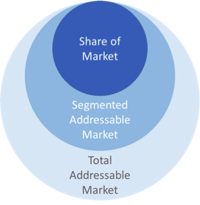

In order to try to appropriately scope the market and maximize adoption, we will use the framework shown at the right. This framework includes three main components:

- Total Addressable Market (TAM) – The aggregate market need for a Vendor’s data product

- Segmented Addressable Market (SAM) – The total customers targeted by a data Vendor

- Share of Market (SOM) – The customers served by a data Vendor

This framework begins with a “global” consideration of all potential use cases and associated customer groups. It then scales down the market to focus more on solutions that can be implemented quickly as proof of concepts.

Total Addressable Market (TAM)

Assessment of the Total Addressable Market (TAM) dictates whether a data product makes an attractive business case. This is a basic evaluation of the total user potential for a data product. To accomplish this appraisal, Vendors should create an exhaustive list of all potential use cases and customers for their available data.

Key questions a Vendor should ask include:

- Which industries could use this the data?

- What types of business would use the data?

- What use cases would the data support

Each use case will have a different impact on an organization. In turn, each organization will have a different opinion on the value they receive for it, and thus a different interest in buying the data product at a given price.

In order to complete the basic TAM assessment, Vendors should create a list of both Potential Customers by Industry and Potential Data Use Cases. With these lists in hand, Vendors will understand which data is of greatest value to the overall market.

Segmented Addressable Market (SAM)

The Segmented Addressable Market (SAM) represents the customer segments of the TAM that a Vendor chooses to target. SAM is ultimately influenced by the willingness-to-pay (or ability-to-pay) of the customer targets.

While the TAM assessment was primarily an externally facing investigation, the SAM assessment is an internally focused exercise that centers on four dimensions:

Business Model - A Vendor’s go-to-market strategy for data products

Decisions include:

- Go-to-market channel

- Geographic focus

- Industry focus

- Use case focus

Organizational Capabilities - A Vendor’s technology infrastructure & service capabilities

Assessment involves:

- Push vs. pull data

- API access

- Product/data update intervals

Corporate Governance - A Vendor’s ability to distribute data

Protocols include:

- Internal controls of data assets

- Terms of use

- Terms of service

Data Product Quality - The data’s ability to drive decision-making

Evaluation of data’s ability to provide:

- Market transparency

- Indication and predictive value to correlated events

- Representation of a population’s behavior

Vendors need to decide on their strategic approach to each of the dimensions listed above. Each of these strategic decisions will have an effect on the SAM.

Share of Market (SOM)

The Share of Market (SOM) represents the customers that a Vendor serves. This is a subset of the SAM. Three general factors affect the SOM: breadth of appeal, competition and use-case dependency. A Vendor’s goal is to understand the interplay of each factor in order to structure a product that meets customer demands and captures the largest SOM possible.

Broad vs. Niche Appeal

There are nearly limitless ways that Vendors can structure products. Sophisticated data Vendors create niche products to serve particular use cases and user groups needs. To accomplish this, Vendors have intimate knowledge of their customers and use cases, thus they can structure and price data products that maximize their SOM across segments. Many Vendors are already structuring focused data products segmented by:

- Geography

- Industry

- Depth of detail

For less mature data Vendors, a broad approach is more appropriate because it allows them the chance to enter the data economy with a successful proof-of-concept. A broadly focused data product will have a more open scope of included data and will allow a Vendor to understand how customers will use the data product. This customer understanding enables Vendors to adjust future products in order to capture more SOM.

Competing Products

While competing data products may reduce a Vendor’s SOM, they also validate that an addressable market already exists.

It is highly unlikely that one data provider will own a monopoly on market insights. Many, if not most, data buyers see a need to use data from multiple sources in order to enhance, validate and verify their courses of action.

Competing data products serve as references and benchmarks that a Vendor can use to improve future products. In light of competing data products, Vendors should consider differentiating based upon their data product’s aspects such as: price, update frequency, size, scope of information provided, granularity and included variables.

Use Case Dependency

Dependency refers to the critical nature of the data product for the buyers’ use cases. If decisions cannot be made without the Vendor’s data product, then dependency is high, and the Vendor will be able to improve its SOM. However, if the data product can help make more accurate decisions, but is simply a “nice to have” feature, then the data’s value (and the Vendor’s SOM) will be a function of the price that the customer segments are willing to pay.

With a clear understanding of the TAM, and SAM, a Vendor can now make the necessary structuring decisions to maximize SOM and, ultimately, revenue from data sales.

In the next part of this series, we will more deeply assess the structuring considerations that go along with product construction.

Structuring ensures that Vendors’ data can more effectively deliver on customer needs.

If you are interested in learning more about how to select and structure data products, please download the whitepaper “The Practical Guide to Selecting & Structuring Data Products.”

Missed the first part of the series? See "Structured to Sell - Part 1 of 4: Data Monetization Motivations" to help your organization understand how to sell data.