The following post is part of a five part series detailing how to successfully bring a data product to market. To learn more, download the free “Visionary Leader’s Guide to Data Monetization.”

Economic Trade-offs:

Based upon decisions in the previous step (Go-To-Market Guidebook #2: Built for Buyers), a data vendor should now hopefully be able to assess the cost to make data available for sale. This effectively serves as the price floor for the data product. From there, the task of pricing data is a balance of art and science.

To start, data vendors need to recognize the economic pricing tradeoffs in regards to price elasticity and willingness to pay.

- Products priced too high won’t sell

- Products priced too low run the risk of leaving money on the table (AKA consumer surplus)

Value Drivers

With this in mind, vendors must understand what really drives the value for their data products. At DataStreamX, we’ve coined these drivers as Three R’s of Data Value:

- Richness – Accurate, robust, granular, detailed, frequent

- Reliability – Authentic, dependable, complete, consistent

- Rarity – Uncommon, irreplaceable, extraordinary While the “Three R’s of Data Value” are can then be broken down into eight specific and scorable elements that

Pricing process:

Now that you understand the higher level elements invovled with data pricing, lets look into the pricing process. There are key areas that you need to fully understand in order to price data products effectively. These are:

- Value - based upon the likely use cases

- Willingness to pay – based upon potential buyers

- Attractiveness - based upon qualities inherent to data and company

- Corporate pricing strategy – based upon market share

With a firm understanding of each of these aspect, vendors can likely estimate an acceptable price that reflects the value their data can deliver.

For more information on how to sell data, downoad the free guide, “The Visionary Leader’s Guide to Data Monetization.”

Use-Based Value

Put simply, data’s value (or any product’s value) is driven by what that product will be used for and the problem that is can help solve. This means that value is almost entirely determined by the buyer. And since different buyers will have different uses, there will inevitably be an uneven perception of value.

For example, take the case of geo-positioning traffic data. This data could be used by a road constructiuon company to accurately estimate a bid for a long-term government contract that could be worth millions of dollars over several years. Likewise, this data might also be used by a smaller local delivery company to more accurately assign drivers, plot safe routes and deliver better customer service. This increase in service quality might not have a measurable ROI in the same way that the government contract would, however there is value nonetheless.

Understanding the various use cases possible (and the associated value derived from them) is a key step to pricing data.

For more information on pricing pricing data, read “The Practical Guide to Pricing Data Products”

Willingness to pay

A buyer’s willingness to pay is associated to the value that is derived from the data itself. However, theere are key differences, namely:

- The amount of money that a buyer is willing to spend on information

- The sophistication in using external information to solve problems

- The ability to readily put data to use in solving problems

While some use cases might be readily apparent and incredibly valuable, the buyers associated with those use cases might not yet have the budgets allocated or technical sophistication to pursue them. This should be noted, as it has the potential to push out the sales cycle.

For more information on pricing pricing data, read “The Practical Guide to Pricing Data Products”

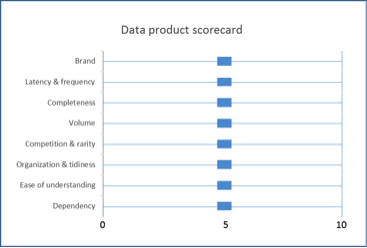

Attractiveness factors

Independant of both use-based value and willingness to pay factors, there are additional factors inherent to data sets that need to be scored in order to accurately asses the data’s ability to effectively deliver value. These are factors such as:

- Brand equity

- Latency/frequency

- Completeness

- Volume

- Competition & rarity

- Organization

- Ease of understanding

- Dependency

Honestly scoring data on these factors will help a data vendor to understand the competitive positioning oftheir data set and the price they can expect to charge.

Strategy

Finally, after understanding the three previous factors, an organization needs to make an internal strategy decision about whether they price their data to try and capture the maximum willingness to pay or to capture greater marketshare. This is an important decision as an organization will want to price competitively, so as to be able to rapidly capture value, but also making sure to account for the value derived from their data.

Closing note:

Keep in mind that the same dataset can be structured several ways and command different prices. For example, a company with data on gas stations across Europe might track several data points such as locations, number of pumps, and hourly car traffic. The company with this dataset needs to understand who the possible buyers of the data are, as this will help dictate the structure and the pricing. For example, the company could create data products for each country or aggregate all of Europe. Separately, the company could chose to provide real-time, weekly, monthly or yearly traffic to each of the pumps. With just these parameters alone, there are at least 400 combinations for data products, each with a distinct value to the market.

To continue learning about how you can bring data products to market, please click below:

Missed the first part of the series? See "Go-To-Market Guidebook #1: What you got?" to help your organization understand how to sell data.