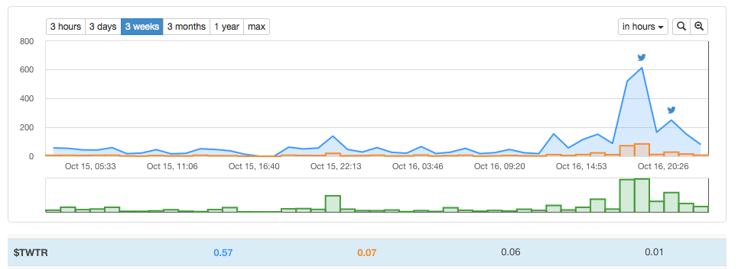

Just before 11am New York time on Oct 16th, Twitter’s stock started showing unusual activity on the Flockpit Dashboard. Twitter had traded sluggishly in the morning, hence such an abrupt rise in activity was a strong indicator for an upcoming price movement and a quick check revealed that a tweet allegedly posted by Steve Ballmer, claiming that he had bought 4% of the company, was the hot topic.

FlockPit Dashboard (Times in CEST)

As we observed the development of the social media discussion and the stock price up to a 2.9% jump at 11.30am, it became evident that traders were prudent and patient when faced with an unconfirmed social media rumour and didn’t jump at the opportunity to buy $TWTR immediately. This was rather new behaviour.

In late 2014, a social media rumour sent Ebay’s stock up and down by 2% within minutes after tweets emerged claiming that Google was planning a takeover. These rumours turned out to be false, and some traders got burned. The same happened in early 2015, when Samsung was rumoured to be in acquisition talks with Blackberry. Back then, this information – which also turned out to be false – had sent the stock soaring by 29%.

This time no immediate large-scale position entries were observable. Traders apparently didn’t believe that the newly opened @Steven_Ballmer Twitter account was real and journalists were desperately trying to verify the information. Once the the tweet had been deemed as legitimate, the stock jumped by 2.9% within one minute and rose 5.95% until the market closed.

The events of October 16th showed us again how a single tweet can significantly move the market. This particular event though, also taught us that traders don’t jump at any random piece of potentially profitable social media information in hordes, but behave prudently and sceptically towards anything that doesn’t come from a trustworthy source.